Pros and Cons of Pet Insurance

In 1982, the famous TV collie Lassie was the first pet in the United States to receive an insurance policy. The pet insurance industry has grown continuously since then, with the total number of insured pets in the U.S at 5.7 million at the end of 2023 — 17% more than the previous year. Still, there are pros and cons to insuring your pet, and some people decide that pet insurance isn't for them.

Owning a pet can be rewarding, supportive, fun and even hilarious. It's also a big responsibility and can be expensive. Pet insurance is one of the ways you can help support your pet's well-being and safeguard your finances. Many Americans consider their pets family members and will cover veterinary costs to the best of their ability. There are pros and cons to pet insurance, and whether you choose to get it or not, it's important to have a plan in place in case of an emergency.

What Is Pet Insurance?

Pet insurance is a form of coverage bought by pet owners that partially or fully pays for the veterinary treatment of an injured or ill pet. There are many different types of policies, and most pet insurance companies specialize in cats and dogs.

What Does Pet Insurance Cover?

Now that you understand what pet insurance is, you are likely wondering what pet insurance pays for. The exact details of your coverage depend on the type of plan you choose. Similar to health insurance for humans, you can select the plan that best suits your pet's needs and your budget.

Accident-Only Coverage

An accident-only plan will cover some or all costs associated with accidents. No one expects something bad to happen, but the following coverage applies to an accident-only plan:

- Broken bones from falls and other accidents

- Lacerations and cuts

- Swallowed objects and foreign body ingestion

- Bite wounds from other animals

- Burns

- Certain types of poisoning

- Injuries from being hit by a car

Accident and Illness Coverage

Accident and illness coverage is the most popular type of plan among pet owners because it covers accidents and other unpleasant surprises from bee stings to infections, diseases and even cancers. Because illness and accident plans offer more coverage than accident-only plans, they will be more expensive.

Routine Wellness and Preventive Care Coverage

Wellness plans are often sold as add-ons to traditional accident-illness policies, though they can also be purchased alone. Some of the additional things these plans might cover include:

- Annual checkups

- Routine vaccinations

- Senior checkups

- Heartworm testing

- Parasite prevention medications

What Isn't Covered by Pet Insurance

All plans are different, though pet insurance doesn't typically cover preexisting conditions. Some items that aren't generally covered by insurance policies are occasionally included in wellness plans, so it's important to read through your policy documents. Here are some more items infrequently covered by insurance polices:

- Behavioral treatments

- Experimental treatment

- Food and vitamins

- Cosmetic or elective procedures

- Non-veterinary expenses

- Breeding and pregnancy

- Grooming

- Preexisting conditions

- DNA testing

- Boarding and kennel fees

- Lost or stolen pets

- Taxes and administrative fees charged by your veterinarian

The Pros of Health Insurance for Pets

There are many pros to having coverage for your pet. Here are some of the key reasons so many owners choose to purchase health insurance for their furry friends.

Financial Security

Pet insurance will pay for or reimburse you for a large percentage, or sometimes the full amount, of unexpected veterinary costs. Some companies even offer immediate coverage that allows your insurance to pay directly instead of filing a claim for reimbursement.

Variety and Flexibility

There are many different plans available, so you can find one that works best for you. Pet owners can also upgrade and downgrade plans as they need to. You can choose a plan that suits your budget and your pet and change it either as your pet ages or as your financial situation changes.

You Can Stay With Your Vet

Unlike health insurance for humans, pet insurance doesn't typically restrict you to certain providers. You can usually see any vet you like, so you can find the right fit for you and your pet without restrictions.

Access to Quality Care

Because insurance means you have access to treatments that may otherwise have been out of your budget, your pets can receive the care they deserve without being limited by the cost. Depending on your policy, you may be able to access specialized care or advanced treatments that would otherwise have been out of reach financially.

Peace of Mind

Emergency situations without insurance can put you in the challenging position of choosing between your pet's health and your own financial well-being. Having pet insurance can give you peace of mind, knowing your beloved four-legged buddy will have access to veterinary care should they need it.

The Cons of Pet Insurance

While pet insurance has many benefits, there are some factors to consider before signing up.

Waiting Periods

In most cases, pet insurance doesn't kick in immediately. This delay is to make sure pet owners don't get insurance after discovering their pet has a condition that requires expensive health care. The waiting period can be different for illnesses and accidents. For example, it may be 2 to 5 days before you can access accident coverage and 14 to 30 days before illnesses are covered.

Cost of Premiums

Pet insurance premiums are an ongoing cost, and some pet owners may find they rarely use their coverage. Keep in mind that premiums can also increase as your pet gets older.

Deductibles

A deductible is the amount of money a pet owner is responsible for paying on a vet bill before their insurance policy begins to cover the costs. There are two types of deductibles:

- Annual deductibles: If you have a $300 annual deductible, you will pay the first $300 of vet bills yourself, and your insurance will cover the remaining eligible costs up to the limit of your plan.

- Per incident deductibles: If you have per-incident or per-condition deductibles in your plan, you'll have to pay a certain amount per condition. This amount can be specific to certain conditions, like diabetes, and not apply to others. Or you may have a $100 deductible on every condition or incident, so you'll pay $100 any time your pet has to visit the vet for a new condition.

Limits

Most plans have an annual limit, unless you get unlimited coverage. Limits mean that if, for instance, your plan has a $10,000 limit, your insurance will only pay out a total of $10,000 that year. So even if your pet has eligible vet expenses over $10,000 in a year, if the total of your annual expenses thus far exceeds that number, your insurance won't cover the costs.

Most insurance companies have upper age limits, so not all aging pets can be covered. Whether the age limit is five, eight, 14 or another number can depend on the type of animal, breed, insurance company, policy details and other factors.

Exclusions

Your pet won't be covered for any preexisting conditions, so you can't use pet insurance for an illness or injury that existed before you signed up for your policy. Some breeds are known for certain conditions. For example, if a German Shepherd has shown even minor signs of hip dysplasia, a common condition for that breed, treatment for that condition will be excluded. If you want pet insurance and own a breed prone to certain issues, it's best to activate insurance early before any signs are present.

Hereditary conditions are also sometimes excluded. So, if a Poodle is diagnosed with progressive retinal atrophy (PRA), even after the policy is taken out, treatment might still be excluded because it's known to be a hereditary condition. Each policy will have different exclusions, so it's vital you read the fine print and take time to fully understand your pet's coverage.

Upfront Veterinary Payments

Most pet insurance operates on a reimbursement model, which means you still have to pay the vet bill out of pocket before claiming. However, some insurance companies do offer direct payment options.

How Much Does Pet Insurance Cost?

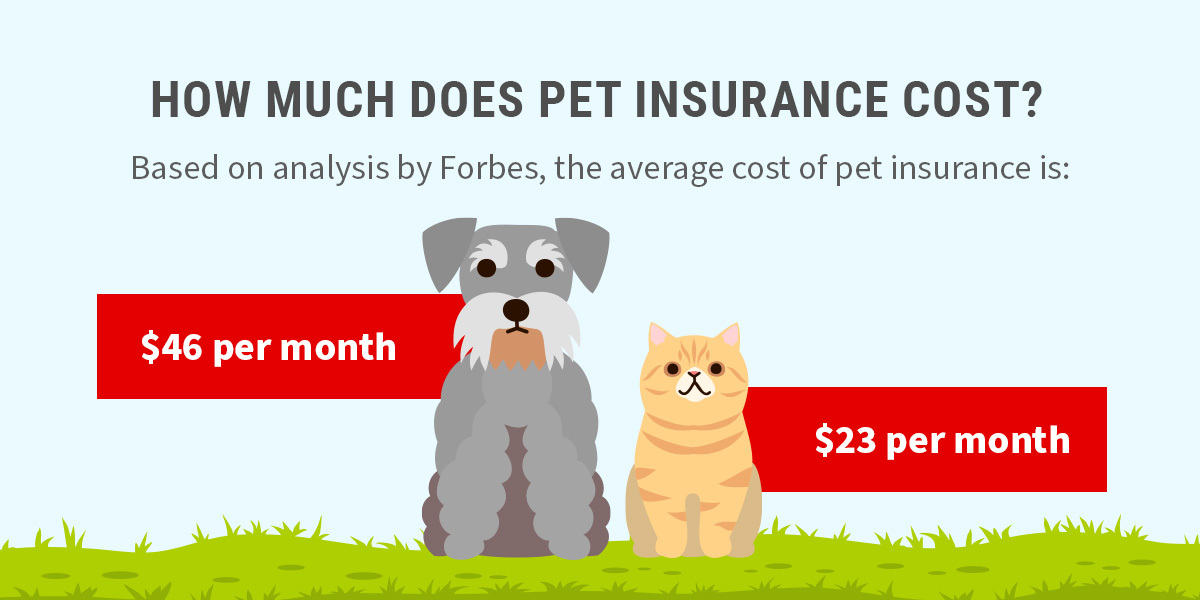

The cost of pet insurance depends on many factors. Based on analysis by Forbes, the average cost of pet insurance is $46 per month for dogs and $23 per month for cats. Insurance for cats is usually cheaper than for dogs because cats are generally known to have fewer vet visits and, therefore, lower veterinary costs.

Whether you're adopting a dog from a rescue shelter or visiting a breeder, it's important to have thought about the financial implications of owning a pet beforehand. Pet insurance costs increase as the animal ages, so it's important to remember your premium can change over time.

Is Pet Insurance Worth the Cost?

Ultimately, whether pet insurance is worth it is up to you. If you wouldn't be able to cover a large unexpected vet bill, pet insurance may be worth it for the financial security it provides. However, you'll need to weigh the monthly cost of pet insurance against the possibility of major vet bills.

Some people prefer to set money aside for emergency vet bills, which can be a worthwhile strategy if managed strictly. Emergency surgery can cost between $2,000 and $5,000, or even more, so if you choose to save, it may take you a long time to put enough money aside.

Is Pet Insurance Worth It for Dogs?

You will have to think carefully about your finances and your dog's breed, age and nature to decide if pet insurance is worth it in your unique situation. An analysis of vet visit expenses showed that it can cost $4,000 for the treatment of an ingested foreign object. So, if you have a dog that chews everything or is prone to eating anything it can find, your pet might be more prone to needing vet visits, making pet insurance more worthwhile.

It can also be more expensive to care for senior dogs, and although pet insurance premiums are higher for older animals, it does become more likely that pets will have health issues as the years go by. Because pet insurance won't cover existing conditions, waiting for your pet to get older before getting insurance can be a risk because they may develop an expensive condition that will then be excluded.

Is Pet Insurance Worth It for a Puppy?

Deciding whether to insure your new furry friend is a personal decision. It is important to consider that puppies explore the world with their mouths and can be prone to accidents and illness. Insurance can give you peace of mind and financial protection in an emergency.

So, alongside learning how to housebreak a puppy, preparing your home, and making sure you have food and other necessities ready, you need to do some research and decide if you want insurance for your new pup. There will be a waiting period before the insurance activates, so it's best to decide early. Whether you get pet insurance or not, prioritize learning basic pet first aid in case your puppy needs immediate help before getting to a vet.

Is Pet Insurance Worth It for Cats?

Ensuring your cat is something you'll have to decide on based on your circumstances. If you feel concerned about the possibility of unexpected large vet bills, then it may be worthwhile. Sometimes, knowing your cat will be cared for makes it worth it, especially for adventurous outdoor cats. But you will have to deliberate over the pros and cons and come to a decision that makes sense for you and your cat.

How to Choose Pet Insurance

Here are some tips if you decide you do want pet insurance:

- Research your pet’s breed: Because some breeds are prone to health conditions, it's advisable to research your pet's breed so you know if they are likely to have health concerns. Once you know more, explore different plans and read the fine print to see if there are particular stipulations about the breed you own that can help you decide.

- Compare available options: There are so many pet insurance options. Shop around and see which one suits your budget and your pet's needs best.

What to Do if You Choose Not to Get Pet Insurance

If you know you don't always have thousands of dollars to hand, create a savings account and add money to it each month to create your own financial safety net for your pet. Whatever your choice, make sure to put a plan in place that ensures your pet will be cared for in an emergency. The most important thing is that you've thought through a practical strategy for if your pet gets into an accident or gets sick. That way, if something happens, you can focus on your pet instead of the bills.

Keep Your Pet Healthy and Happy With Loving Pets

Being responsible is a big part of being a pet owner. Now that you have all the information, you can make a choice that's best for your fluffy buddy's well-being and your own. Once you've considered your pet's needs and your financial situation, make the decision that gives you the most peace of mind.

While planning for your pet's future, don't forget the everyday essentials that contribute to their well-being. At Loving Pets, we're just as passionate as you are about keeping all four-legged friends healthy and happy. Our goal is to get tails wagging and cats purring by providing high-quality treats. Our products are made with healthy ingredients that you can feel good about. Since 2005, we've brought veterinarian-recommended treats and fun, functional accessories to animal lovers across the nation.

Browse our products online for a new way to make your pet's day!